To start using Pay1 Retailer services

To start using our Distributor Service

Our Service

Bill Payments

Earn more by doing Utility bill payments, for your customers easily and quickly of more than 150 companies

Do you want to become Pay1 Retailer & earn amount ₹50,000 per month ?

Join Dukandaron Ka Network

Pay1 has always been Vocal for the Local shopkeepers. Through Pay1, more than 4,00,000 retailers have served around 3crore unique customers in 2,300+ cities. Pay1 has increased retailers monthly earning as well as customer's footfall

- Become Aatmanirbhar Dukaandar and earn Rs.16, 000 extra every month

- No charges to use Pay1 Service

- Earn token on every transaction, which helps in boosting their earnings

- Easy, Fast & Secure to use

- All services in One App

- Loan facility available for retailers

Already in Distributor Business? We have exciting services for you on our Distributor1 application

Our Presence

Pay1 provides an easy to use technology via an app or web portal which gives merchants access to new products and services in the market, provide technology to manage their store and become a digital payment and banking point

We are trusted by more than 4 lakhs merchants in more than 2300 Cities, these merchants today are able to optimally utilise their resources by being a part of the Pay1 platform

Our Partners

Our Partners

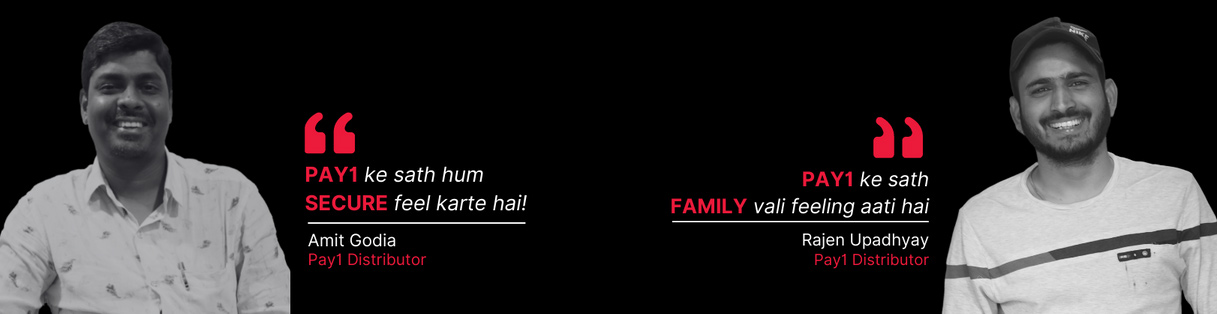

Success Stories

How Pay1 transforms lives ?

Success Stories

How Pay1 transforms lives ?